In the dynamic world of real estate, whether you’re a prospective homeowner, a seasoned investor, or a newbie in the market, there’s one concept you must master to thrive – due diligence. This process is the cornerstone of making informed decisions, avoiding expensive blunders, and ensuring your real estate endeavors reach their full potential. In this comprehensive guide, we will delve into what due diligence in real estate entails, why it is of paramount importance, and how you can become a proficient practitioner. So, let’s explore this pivotal aspect of real estate, to enhance your understanding.

1. What is Due Diligence in Real Estate?

Before we delve into the finer details of due diligence, let’s establish a clear definition in the context of real estate. Due diligence is the systematic and exhaustive investigation and evaluation of a property or real estate transaction before the deal is finalized. Think of it as the process of “doing your homework” to ensure that you are fully aware of all the nuances involved.

2. The Vital Components of Due Diligence

Understanding due diligence necessitates breaking it down into its essential components. Here are the critical facets to focus on during this meticulous process:

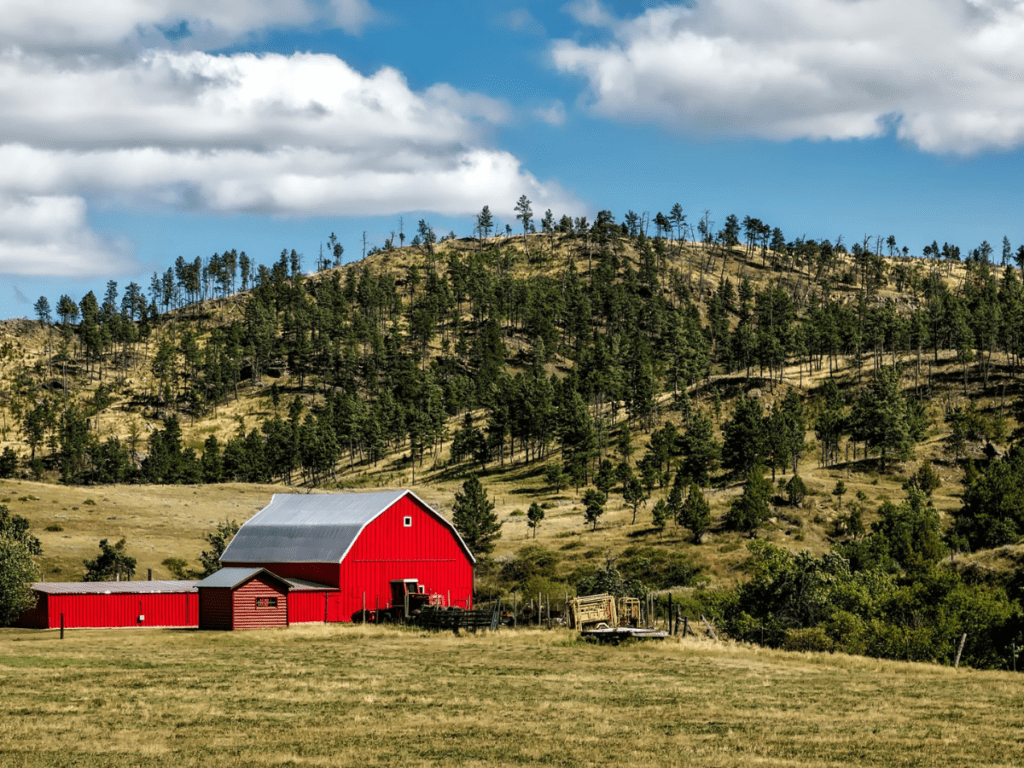

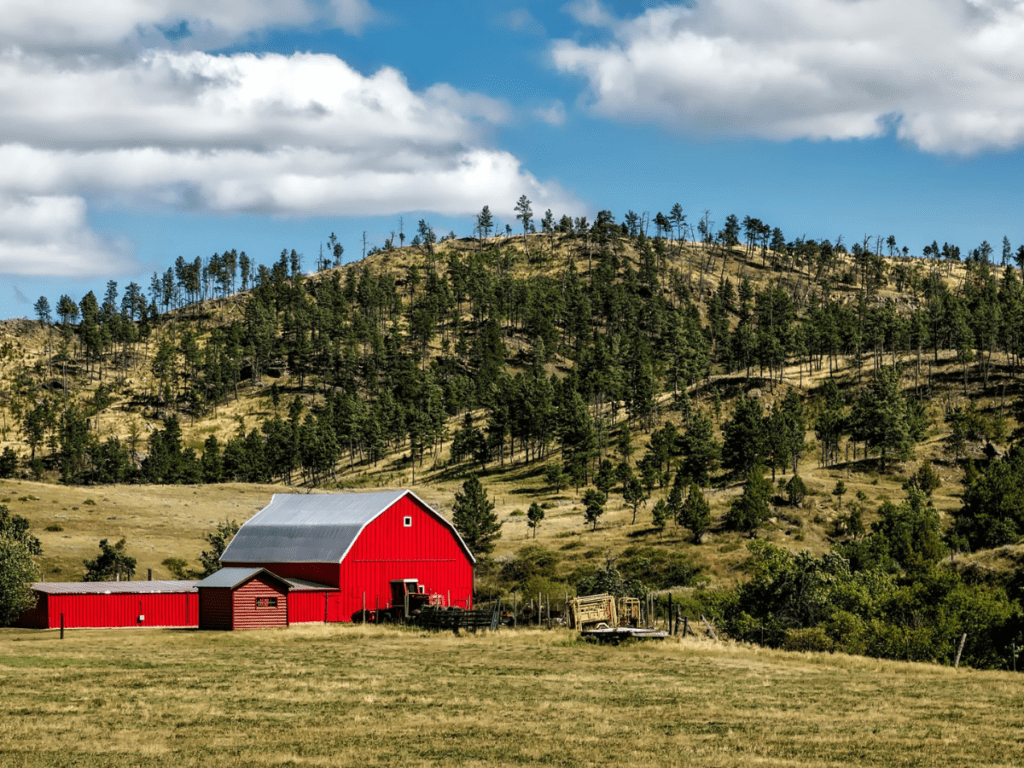

A. Land Inspection

A comprehensive land inspection is a vital necessity when considering land acquisition. This process entails enlisting the expertise of a qualified inspector to evaluate the land for sale‘s physical condition and suitability for your intended purpose. During this inspection, various critical factors are examined, serving as your protection against unforeseen and potentially expensive challenges hidden beneath the surface.

B. Title Search and Ownership Verification

A clear title is paramount. A title search uncovers any potential liens, easements, or ownership disputes that could hinder your intended use of the property. Without a pristine title, you may find yourself ensnared in legal tangles that jeopardize your investment. Therefore, it’s essential to use a reputable Title company to buy your property.

C. Financial Analysis

Financial due diligence involves dissecting the property’s financial history, including income, expenses, and cash flow. This process aids in determining whether the property aligns with your financial objectives and if it’s a sound investment. You should also assess the property’s potential for appreciation or depreciation.

D. Legal Compliance

Take time to scrutinize local zoning laws, building codes, and other pertinent regulations that might impact the property’s use. Non-compliance could result in hefty fines or the need to undertake expensive modifications to bring the property in line with the law.

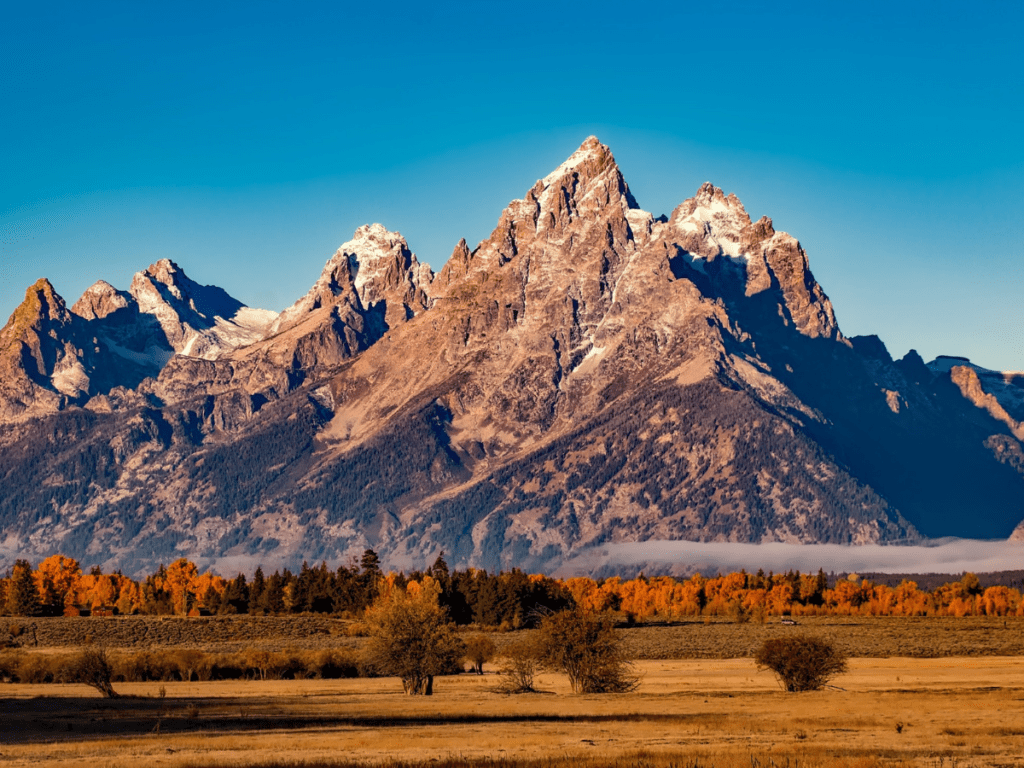

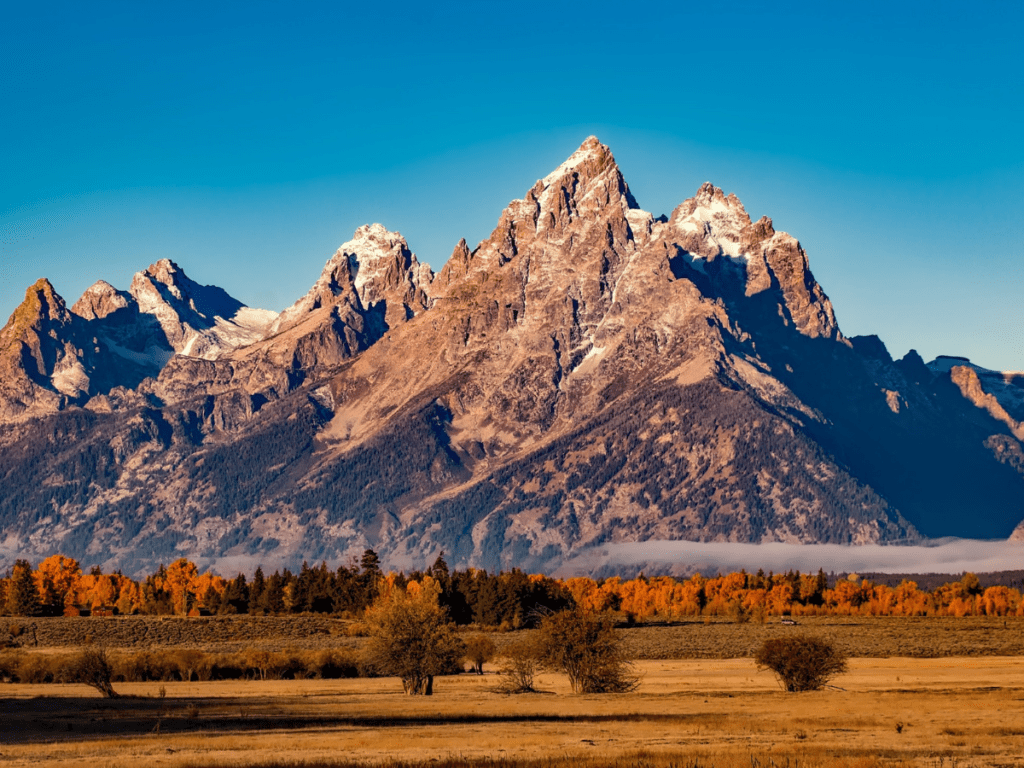

E. Environmental Assessment

Environmental due diligence entails evaluating potential environmental hazards or issues associated with the property. This could include soil contamination, hazardous materials, or proximity to ecologically sensitive areas. Neglecting these concerns can lead to substantial liabilities down the road.

3. The Significance of Due Diligence in Land

With a firm grasp of the components, it’s crucial to understand why due diligence is paramount in the realm of real estate.

A. Risk Mitigation

Real estate investments inherently carry risks. Due diligence is your armor against these risks. By proactively identifying and addressing potential problems, you can mitigate risks and protect your investment.

B. Informed Decision-Making

Imagine purchasing a property without conducting due diligence, however, only to discover costly issues that could have been avoided. Through thorough research and investigation, as a result, you arm yourself with the knowledge needed to make informed choices. This ensures you’re not entering a transaction blindly.

C. Negotiation Leverage

The insights gained during due diligence can provide valuable negotiation leverage. You can negotiate a lower purchase price to account for issues or request that the seller address them before closing the deal.

D. Legal Protection

Real estate transactions involve numerous legal aspects. Conducting due diligence helps protect you legally by ensuring that all necessary documentation is in order and that you’re not unknowingly violating any laws or regulations.

E. Investment Success

Ultimately, due diligence is a pivotal factor in real estate investment success. It safeguards against impulsive decisions, reduces costly surprises, and aligns your investments with your financial goals. Successful real estate investors recognize the value of this process.

4. How to Excel at Due Diligence in Land

Now that you grasp the significance of due diligence, let’s explore how you can become proficient in this critical process.

A. Education and Training

Begin by educating yourself about real estate due diligence. Numerous courses, books, and online resources are available to help you understand property inspection, financial analysis, legal compliance, and more. Consider seeking guidance from experienced professionals or mentors in the field.

B. Build a Robust Network

Networking is vital in real estate. Connect with real estate agents, inspectors, attorneys, and other professionals who can provide valuable insights and guidance during the due diligence process. These connections can also lead to potential investment opportunities.

C. Create a Due Diligence Checklist

Develop a comprehensive checklist outlining the specific steps and components you need to cover during the due diligence process. This will help you stay organized and ensure that you don’t overlook any critical aspects. Tailor your checklist to the type of real estate investment you’re pursuing.

D. Leverage Technology

Take advantage of technology to streamline your due diligence efforts. Various software tools and apps can assist with property inspections, financial analysis, and document management. These tools enhance your efficiency and effectiveness.

E. Seek Professional Assistance

When in doubt, seek professional assistance. Real estate attorneys, property inspectors, and financial advisors offer invaluable expertise and guidance throughout the due diligence process. Although this may incur additional costs, it’s often a wise investment to safeguard your interests.

In the realm of real estate, due diligence is not a mere suggestion; it is an absolute necessity. By meticulously researching and analyzing properties before making investment decisions, you safeguard yourself from unforeseen and costly surprises, make informed choices, and enhance your prospects of success in the real estate market.

Whether you’re a first-time land buyer or a seasoned investor, mastering due diligence is a pivotal step toward realizing your goals in the land arena. Thus, remember to “do your homework” diligently, and you’ll be well on your way to becoming a shrewd and prosperous real estate investor.

This invaluable resource will walk you through every essential step of due diligence, ensuring that you don’t miss a thing in your real estate transactions.

Moreover, remember, that informed decisions and meticulous research are your greatest allies in the real estate arena. Take the next step towards achieving your real estate goals by visiting our website or contacting us today. Your success story in real estate begins with due diligence, and rest assured, we’re here to help you every step of the way.