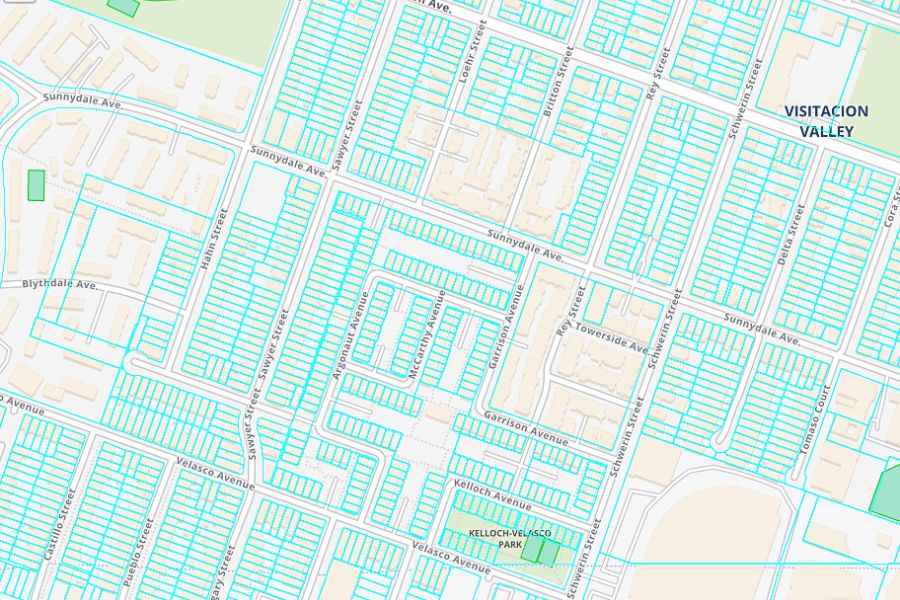

Have you ever wondered about the maps you see at town meetings or in the assessor’s office for property deals?

Today, we’ll explain the significance of Tax Maps and Assessor’s Maps in property transactions, making it easier to understand how they impact property distribution, valuation, and the buying and selling of real estate.

Let’s dive into where property lines and assessed values intersect, shaping property transactions.

Tax Maps: A Bird’s Eye View of Property Distribution

Tax Maps show how land and properties are divided up within a town or municipality. It is a big-picture view of the area, like looking at where each piece represents a different property or parcel of land.

These maps provide important information such as property boundaries, zoning details (which determine how land can be used, like for residential or commercial purposes), and the general layout of the land. They’re like a blueprint of the town’s structure, helping people understand where different types of properties are located.

However, while Tax Maps are great for seeing the overall layout of the town, they don’t provide detailed information about individual properties. For example, they won’t tell you exactly how much your neighbor’s house is worth for tax purposes.

That’s where Assessor’s Maps come in, which provide more specific details about individual properties and how their value is determined.

Assessor’s Maps: Delving into Property Valuation

Assessor’s Maps are the detailed records used by assessors to evaluate individual properties. They go beyond property boundaries (seen in Tax Maps), providing information on parcel numbers, land use, and assessed values.

When reassessing properties, the assessor’s office refers to these maps to ensure accurate evaluations based on market values.

These maps help assessors consider property details and changes over time, ensuring fair evaluations based on market values. They’re crucial for precise property assessment.

For buyers and sellers, understanding how Tax Maps and Assessor’s Maps work together is important when dealing with property transactions.

Land Transactions: Navigating the Intersection

Here’s why understanding how Tax Maps and Assessor’s Maps work together is important when dealing with property transactions:

Even though Assessor’s Maps provide detailed information about individual properties, Tax Maps are still important in property transactions because they offer a broader view of property distribution and zoning regulations.

Tax Maps help buyers and sellers understand the overall layout of the area, including where different types of properties are located and how zoning regulations may impact them.

Essentially, Tax Maps provide the context needed to interpret the detailed information found in Assessor’s Maps, helping buyers and sellers make informed decisions about property transactions.

Property for Sale Scenario: A Closer Look

Let’s consider a scenario to further illustrate the differences between Tax Maps and Assessor’s Maps:

Imagine you’re interested in buying a piece of land in a suburban town to develop a small commercial property. You’ve identified two potential plots: Plot A and Plot B.

Plot A:

- According to the Tax Map, Plot A is located in a commercial zone, making it suitable for your intended commercial development.

- However, the Tax Map doesn’t provide detailed information about the specific boundaries or characteristics of Plot A.

- To get more information, you consult the Assessor’s Map, which reveals that Plot A is slightly smaller than you anticipated, with irregular boundaries that could affect your development plans.

- Additionally, the Assessor’s Map indicates that Plot A is adjacent to a residential area, raising concerns about potential zoning restrictions or neighbor objections to your commercial project.

Plot B:

- On the Tax Map, Plot B appears to be larger and more uniform in shape, with clear boundaries.

- The Tax Map also indicates that Plot B is situated in a mixed-use zone, allowing for both commercial and residential development.

- However, without consulting the Assessor’s Map, you’re unable to determine the specific assessed value of Plot B or any potential discrepancies in property boundaries.

- Upon reviewing the Assessor’s Map, you discover that Plot B has a higher assessed value compared to Plot A, suggesting that it may be a more valuable investment despite its larger size.

In this situation, both Tax Maps and Assessor’s Maps are crucial for assessing the suitability and value of plots for your commercial project.

Tax Maps give an overall view of zoning and property layout, while Assessor’s Maps provide specific details about each property, like assessed values and boundaries.

By using both maps, you can better choose the right plot for your investment goals.

Explore available properties and learn more about land transactions at The American Dream Land. Questions? Call or text us at +1-646-915-1234.

Note: This article is for informational purposes only. Green Tara Investments LLC and www.TheAmericanDreamLand.com do not provide legal or tax services, and it is best to consult your Legal and Tax advisors before making any investment decisions.